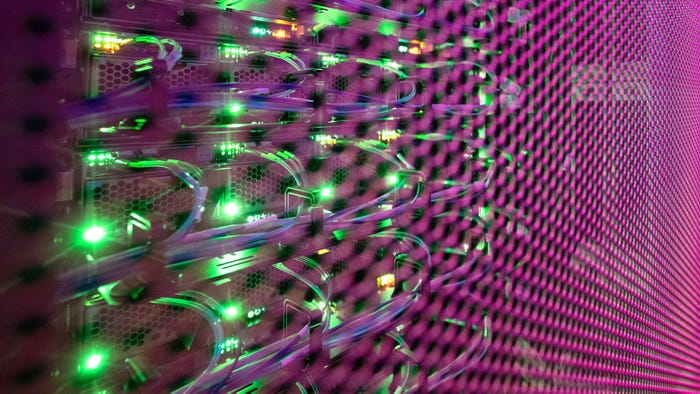

AI and Cloud Workloads Drive Data Center Demand

A new report by JLL predicts data center supply imbalance will last at least through 2024 as AI and edge computing adoption increase.

Artificial intelligence workloads and continued cloud adoption are fueling explosive demand for data centers, leading to a shortage of colocation space and rising prices, a new report by JLL shows.

The current and near-term supply of data center capacity in major markets and most secondary markets can't meet demand as large cloud service providers and enterprises in finance, healthcare, and other markets compete for available data center space, according to JLL's new 1H 2023 North American Data Center Report.

Holcomb-JLL

As a result, colocation providers have increased pricing by up to 20% to 30% year-over-year in primary markets, while secondary markets with some excess capacity — such as Columbus, Ohio; Salt Lake City; Reno, Nevada; and Austin, Texas — are supporting the overflow demands from the primary markets, according to JLL, a global commercial real estate and investment management company.

"We've never been in a situation with such a supply and demand imbalance. A year-and-a-half ago, we had a healthy vacancy rate in most markets around the U.S.," said Curt Holcomb, executive vice president and co-lead of JLL's data center markets practice. "That meant we could pretty much find a home for all the requirements that are out there, and that has completely changed."

Demand for data center capacity began to outstrip supply in the fourth quarter of last year, Holcomb said in an interview with Data Center Knowledge.

"We saw some hyperscalers take large swaths of space and capacity. Then when the AI craze really hit, we've had a lot of AI companies competing with typical enterprise customers, the cloud guys, and the hyperscalers on what is available," Holcomb said. "We are seeing very low supply and significant increases in rental rates."

Most of the data center supply that will be delivered in the last half of 2023 and 2024 has been pre-leased or is under exclusivity agreements, resulting in limited options for organizations that have not planned ahead, according to the report. The supply chain imbalance is expected to last through 2024 and possibly well into 2025, he said.

Holcomb's advice for organizations: If you need data center capacity from colocation providers in the future, start planning now.

"Our advice to our clients is that you need to think about your requirements and think about timing," Holcomb said. "If you think you're going to need capacity at the end of 2024, you better be in the market looking today because you're competing with all the other users that need space as well. So you need to get in line. You need to figure out what provider you like, and then you need to cut your deals before they even break ground on their buildings."

In fact, continued supply chain issues for technology, a lack of available land, and power limitations have lengthened data center development timelines to three to five years or more, the report said.

Data Center Trends: AI and Edge Computing Adoption

AI is expected to accelerate data center demand even more as cloud providers increasingly offer GPU-as-a-service offerings, AI companies offer new AI services, and enterprises race to adopt the technology, Holcomb said.

Data center operators will need to deploy powerful, high-density server clusters and other infrastructure to support new AI requirements, which in some cases can drive densities to 50kW to 100kW per rack, the report said. Many colocation providers have increased voltage delivered to the floor to 415 volts to reduce the upfront cost of delivering power to the high-density servers, the report said.

In addition, demand for edge data centers is increasing as hyperscalers add edge network nodes to be closer to population centers outside of core markets. Doing so improves performance and reduces latency for AI applications such as ChatGPT, the report said.

Capital Markets Activity Remains Strong

Despite higher interest rates this year, lender and investor demand in the data center market have remained strong. Record-setting merger and acquisition activity continued, while data centers are still attracting a variety of lenders, including life insurance companies, banks, debt funds, and the CMBS (commercial mortgage backed security)/SASB (single-asset, single borrower) market, the report said.

About the Author

You May Also Like