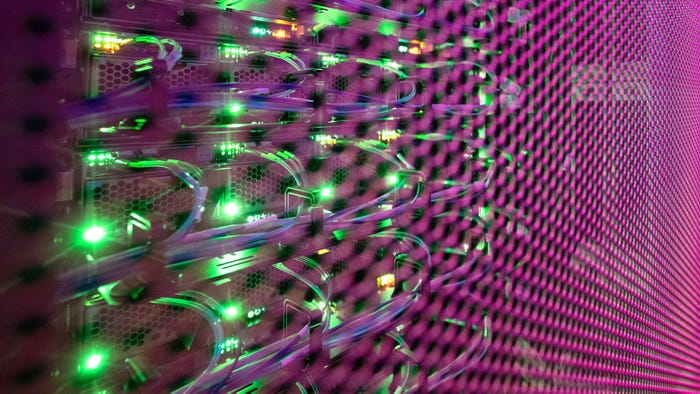

Colocation Data Center Trends, Predictions, and Opportunities for H2 2024

Midway through the year, industry experts outline the major challenges and opportunities facing colocation data center operators, vendors, and clients.

As power demands surge amid the unrelenting AI boom, analysts assess the growth of the colocation data center market, outline the risks the industry faces, and look ahead at innovations that may help colocation facilities meet organizations’ unprecedented energy needs.

Getting Off the Cloud

After a period of mitigated investment in data center facilities and staff, many organizations are moving workloads away from the cloud, according to Alvin Nguyen, senior analyst at Forrester. At the same time, the energy demand for vendors is soaring. “Many organizations are finding it easier to work with a colocation partner, especially when looking at generative AI and the potential cost to support it on-premises.”

Nguyen said the colocation data center market has been growing with a compound annual growth rate ranging from just below 10% to over 14% (depending on the source), and he doesn’t expect that to change any time soon. “Even if the generative AI bubble bursts, there is still plenty of demand,” he said, adding that the potential for market prices to drop will depend on how much extra capacity is built.

‘A Competition for Space, Power, and Water’

Escalating power needs can’t be met simply by modernizing or retrofitting older facilities, Nguyen said, echoing the panel discussion during a webinar hosted by Data Center Knowledge earlier this year. The need for new data center construction projects presents both difficulties and opportunities, according to Mike Rechtin, a partner in DLA Piper’s Real Estate group. “Building new data centers in areas where people live has become a challenge,” Rechtin said, citing a “‘not in my backyard’ attitude, especially in affluent neighborhoods.”

Nguyen summed up the real estate challenges facing vendors: “Building more capacity where there is enough energy, water, and space that is also close to end users” and cited increased competition in residential, commercial, and industrial markets.

Rechtin said the limitations of expanded construction in densely populated areas mean that data centers are increasingly being developed in rural areas with access to power distribution. This, he says, will be a boon to the construction industry. “We see a lot of room for industrial builders to grow their businesses. Because of huge demand, builders who may have been previously contracted to build a warehouse or similar industrial development are now being contracted to build data centers, even if that type of project is not in their core portfolio.”

GenAI Is Not the Only Colocation Growth Driver

While it’s no surprise that AI has intensified the need for power and storage capacity, New York-based analyst for IBISWorld Alexander Govdysh highlighted other factors in higher energy requirements and data center colocation demand. These include a greater push after the coronavirus pandemic toward e-commerce and a digitization of services.

“Parallel sectors such as finance will continue to embrace newer technology for things like Bitcoin mining,” Govdysh said. “This will enhance colocation center leasing costs and boost revenue.” He also cited the stabilization of inflation and positive economic sentiment among businesses as accelerants in colocation center development.

Still, Govdysh predicts AI will continue to be the major instigator in the rising need for colocation facilities. “Many businesses and consumers are embracing AI in their daily lives,” he said. “The intensity of these tasks, which range from image creation to computer code scripts, takes up much more energy with each subsequent AI update, creating greater need for more bandwidth within the colocation centers.”

The Risks and Opportunities of AI

The speed at which the AI sector is evolving presents its own set of risks, Nguyen said, raising the hypothetical prospect that future generative AI approaches could be less power-hungry. “But this also represents an opportunity for colocation vendors,” he said, because “investing in data centers that can satisfy current generative AI needs is expensive. A colocation vendor can absorb that risk and will be a good partner to explore generative AI ambitions over the next few years until a firm answer on generative AI’s future can be determined.”

AI is also being used to help manage data center usage and workloads, Nguyen said, sharing anecdotally that one colocation partner Forrester interviewed saw their clients bring in their own sensors to incorporate detailed environmental data into workload balancing. “More remedial tasks such as data management continue to be adopted by AI,” Govdysh added, “boosting operator efficiency and securitization of data.”

This is a Global Industry

According to Jon Hjembo, senior manager of infrastructure research at TeleGeography, a telecommunications research firm, power limitations between interconnection markets is one of the industry’s biggest challenges. He pointed to restrictions in Singapore, Ashburn, Frankfurt, and Amsterdam as the culprits in creating congestion in high-demand campuses and pushing up prices.

Here, too, risk presents an opportunity for the colocation data center industry. “Hub market constraint is an impetus to push networks and data centers into new places,” Hjembo told Data Center Knowledge. “But to capture opportunity in nascent markets, operators have to move fast. They need to watch key growth indicators closely and then jump in before these places get saturated with new infrastructure investment.”

About the Author

You May Also Like