Hyperscalers in 2024: Where Next For the World’s Biggest Data Center Operators?

Amid surging demand for AI services, hyperscale data center operators are targeting rapid, sustainable growth in 2024. Can they rise to the challenge?

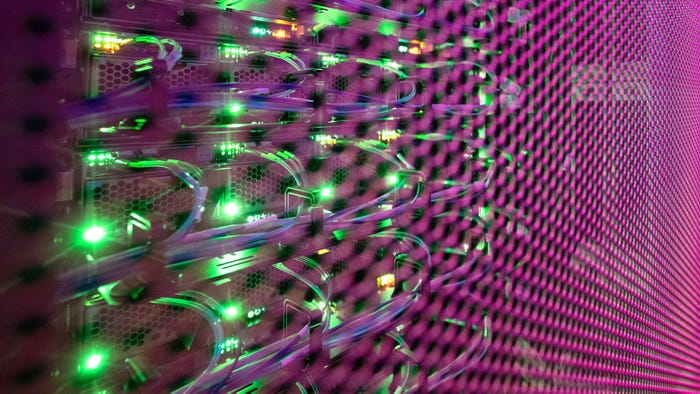

Hyperscale cloud data centers are the backbone of the digital economy and are growing at a rapid pace, with new facilities being announced alongside continuing sustainability and technological advancements.

As we navigate through 2024, the world’s largest hyperscale data center operators continue to expand their footprint, driven by the ever-increasing demand. Among the big players, Meta, Microsoft, Google, and Amazon as well as Oracle and Akamai have been very active in the early months of 2024, with big plans for the months and years ahead.

Synergy Research Group has forecast that over the next six years, the average capacity of hyperscale data centers will be more than double that of current operational hyperscale facilities. Announcements in early 2024 are already showing a strong growth trend.

State of Play: Hyperscale Data Center Projects Underway in 2024

Amazon Web Services (AWS) has announced plans to invest $10 billion to build two data center complexes in Mississippi. Existing AWS data centers are growing with plans for 12 more Availability Zones and four more AWS regions in Germany, Malaysia, New Zealand, and Thailand.

Meta plans to build an $800 million data center campus in Jeffersonville, Indiana. This facility will be the Facebook parent company’s 18th data center in the US and 22nd globally. Meta is also in the process of redesigning data centers in Kuna, Idaho, and Temple, Texas for the emerging needs of artificial intelligence (AI).

Microsoft has committed to investing €3.2 billion ($3.4 billion) to double its AI infrastructure and cloud computing capacity in Germany. This expansion will focus on the existing cloud region in Frankfurt and a newly planned infrastructure in North Rhine-Westphalia.

Google owner Alphabet has announced significant investments in expanding its data center infrastructure to meet the growing demand for its services. Among the most notable announcements so far is the investment in a new data center set to be located at Waltham Cross, north of London in the UK.

“Hyperscalers in 2024 are becoming increasingly selective about new data center locations, as new factors rise in importance,” Gartner analyst David Wright, told Data Center Knowledge.

A Meta data center under construction in Mesa, Arizona (December 2023)

AI is Changing the Landscape for Hyperscale Data Centers

As buildouts continue, Wright said that providers must now consider the ability of a data center’s surrounding energy grid to support a steep increase in AI-related workloads.

“In terms of the make-up of hyperscaler data centers in 2024, we see an accelerating buildup of AI-related infrastructure,” Wright said. “Hyperscalers typically account for around 40% of overall server market volumes. Gartner believes hyperscalers and other service providers will account for 76% of AI server units in 2024.”

Beatriz Valle, Senior Analyst, Enterprise Technology and Services at GlobalData, told Data Center Knowledge that the generative AI revolution is helping to accelerate hardware and data center design.

“AI compute needs will grow dramatically over the next decade as AI research grows exponentially,” Valle said. She added that AI is driving requirements for higher server densities inside hyperscaler data centers as well as special configurations of hardware and software to reach optimal performance.

Steven Dickens, VP and Practice Leader, at The Futurum Group, also sees AI as a defining characteristic for hyperscale data center operations in 2024 which typically includes large-scale deployment of Graphics Processing Units (GPUs). He noted that power-hungry and heat-producing GPUs will place unique challenges on the already overburdened power and cooling systems of many data centers.

"In 2024, the global direction for data center operations is marked by a significant shift towards AI integration into the Ops function and the strategic deployment of GPUs at scale," Dickens told Data Center Knowledge. "These trends underscore the industry's response to the increasing demand for computational power and the imperative for sustainable operations."

The Hyperscale Path to Data Center Sustainability

Balancing the need for growth with sustainability is also top of mind for hyperscale data center operations.

Wright commented that environmental sustainability is a key focus of the hyperscalers in their 2024 data center strategy. He noted that influential customers in regulated industries are seeing stricter climate risk disclosure laws coming in the US and Europe. Those customers are pressuring the hyperscalers for more efficiency and transparency.

"In 2024 we also expect the providers to significantly improve their energy consumption telemetry and reporting, to help customers review and control their carbon footprint," Wright said.

All the major hyperscale data center operators have some form of sustainability pledge and direction to optimize energy consumption and be more green.

"The growth of our cloud infrastructure presents an important challenge: scaling the cloud’s computing power to meet customer demand while also reducing the environmental impact of cloud facilities," Noelle Walsh, CVP Cloud Operations and Innovation at Microsoft, told Data Center Knowledge.

"When customers use services powered by Microsoft data centers, they can do so with the knowledge that we are driving forward on our sustainability goals to be carbon negative, water positive, and zero waste by 2030."

Oracle is even more aggressive than Microsoft when it comes to its sustainability pledges.

"Oracle is committed to matching all worldwide Oracle Cloud Regions with 100% renewable energy by 2025," Leo Leung, Vice President of OCI and Oracle Technology, told Data Center Knowledge.

Leung noted that many Oracle Cloud Regions are already powered by 100% renewable energy, which enables organizations to run their computing services more sustainably and with a lower carbon footprint. To further advance its commitment to sustainable operations, Oracle and its asset recovery partners recycled 99.7% of retired hardware they collected in 2023.

Google is also aggressively building out its data centers with an eye toward sustainability. So far in 2024, Google has announced data center development plans in Fort Wayne, Indiana in the US and Waltham's Cross in the UK. Google also has announced power purchase agreements in EMEA for more than 700 MW of clean energy – including its largest offshore wind projects to date in the Netherlands.

"We remain committed to water stewardship in our data center communities as we grow our capacity, a Google spokesperson told Data Center Knowledge. "Late last year, building on our climate-conscious approach to data center cooling, we introduced our new water risk framework to more precisely evaluate the health of a local community’s watershed and establish a data-driven approach to advancing responsible water use in our data centers."

Drone shot of a Google data center under construction in Winschoten, Netherlands (December 2023)

What's Driving Hyperscaler Data Center Buildouts?

There seems to be no end in sight to the demand for hyperscale data center operations.

Dell'Oro analyst Baron Fung has identified four key reasons why hyperscale cloud and colocation service providers are in a race to build newer and more facilities globally.

AI: New data centers will need to be built from the ground up (rather than retrofitted) to be AI-ready, as the infrastructure has unique cooling and power requirements. What we are seeing is that the service providers are building new AI-ready data centers alongside existing facilities. Once the new ones are ready, the old ones could be decommissioned.

Redundancy and resilience: Service providers are always adding new data center footprint even in existing regions in service. There are several reasons: 1) adding more redundancy in a service region to minimize downtime. 2) Add new capacity depending on utilization metrics. 3) Data centers typically have a lifespan of 15 years. Given cloud computing started to emerge around 10-15 years, it’s time for a refresh.

Edge services: Fung noted that the expectations for service providers to roll out more edge-based services, to support use cases surrounding IoT, smart manufacturing, autonomous driving and smart retail. Smaller and more numerous data centers will need to be distributed close to the edge where the machines and sensors are. Thus, we could see greenfield investments in data centers at the edge.

Data sovereignty: The cloud service providers are also expanding services and capacity in new regions. It is important for performance and data sovereignty requirements to have the data located close to users. While North America and Europe are quite well saturated in terms of service coverage, there are emerging opportunities in APAC and Latin America.

The issue of data sovereignty is all about location, which has always been important for hyperscale data center operators. The closer a data center is to an end user, the lower the latency. In 2024 the issue of sovereignty is particularly important in Europe according to Garner analyst Wright.

"Providers are also paying more attention to data sovereignty regulations in key markets," Wright said. "They must help their Financial Services customers in Europe, in particular, plan for the Digital Operational Resilience Act (DORA), scheduled to go into effect in 2025."

About the Author

You May Also Like