Nvidia Results Show AI Boom Continues Despite Recent Bubble Fears

Revenue for the chipmaker more than doubled to $30 billion for its fiscal second quarter.

August 29, 2024

(The Washington Post) -- Chipmaker Nvidia reported financial results in line with analysts’ expectations Wednesday (August 28), showing sustained demand in buying chips needed for cutting-edge artificial intelligence products.

That could calm recent fears from some analysts and investors that the recent surge in AI investment may ultimately become a bust – at least until Nvidia’s next quarterly update.

Nvidia reported revenue more than doubled to $30 billion for its fiscal second quarter ended July 28 while its net profit surged to $16.6 billion from $6.2 billion a year earlier. It also gave an upbeat forecast, saying it expected revenue to grow 8% to $32.5 billion in the current quarter.

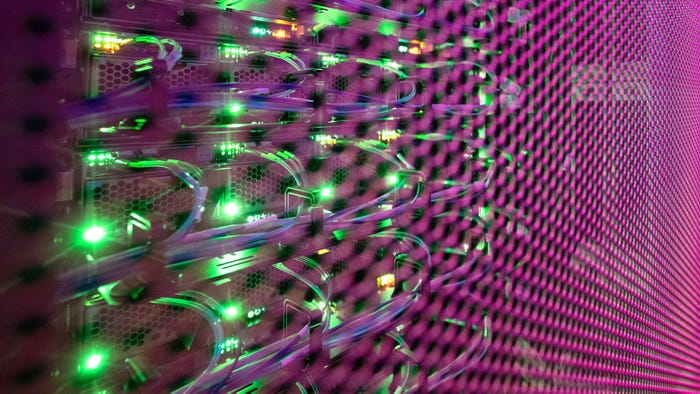

The majority of Nvidia’s revenue came from sales to tech companies including Amazon, Google, Meta and Microsoft building out data centers to power AI projects for themselves or their own customers.

That role as a crucial supplier to software companies developing AI tools such as chatbots has made Nvidia one of the world’s most valuable companies at over $3 trillion and a kind of bellwether for the current AI boom.

Tech giants have all spent billions on the company’s chips over the last two years as they compete with one another to develop new AI algorithms and try to find ways to sell the products to their consumers.

Earlier this summer, some analysts and venture capitalists began raising concerns that the excitement around AI and rampant spending on AI chips was potentially creating a financial bubble.

The value of the biggest tech companies, which had rocketed up during 2023, plateaued over the past few months as investors become more skeptical that Big Tech will reap profits from the massive surge of investment that has lifted Nvidia.

“While the numbers indicate that the AI revolution remains alive and well, the smaller beat compared to the previous quarters adds to the multiple warning signs across the tech space earlier in this earnings season,” said Thomas Monteiro, a senior analyst at Investing.com.

“However, investors should not fear a deeper sell-off. The massive growth in data center chips shows that companies worldwide still have no other option but to keep ramping up their AI expenses, regardless of the costs.”

Nvidia’s financial results have become an obsession for Wall Street professionals and small-time retail investors alike. The company’s value has increased ninefold since the end of 2022, enriching scores of people who’d held the stock before the recent surge in interest and investment in AI – and instilling a deep fear of missing out among other investors.

As the company reported earnings Wednesday, people around the world pored over the company’s press release and commentary from the company’s chief financial officer. The stock seesawed up and down as investors digested the news, before settling down around 6% in aftermarket trading.

Nvidia beat expectations on most metrics, but the company also said that it had made a change in a key step of the production process for its new “Blackwell” computer chips, something that had been previously reported but not confirmed by Nvidia.

During a conference call after the earnings results were posted, analysts peppered Nvidia chief executive Jensen Huang with questions about whether the huge amount of money being invested to buy his company’s chips would be worth it in the end. Huang repeated arguments he’s made before that the entire world is undergoing a transition to using AI, and that demand will keep growing.

Read more about:

Chip WatchAbout the Author

You May Also Like